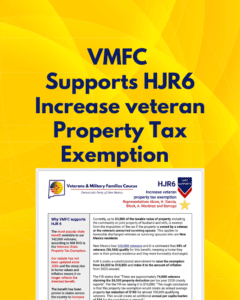

Currently, up to $4,000 of the taxable value of property, including the community or joint property of husband and wife, is exempt from the imposition of the tax if the property is owned by a veteran or the veteran’s unmarried surviving spouse. This applies to honorably discharged veterans or surviving spouses who are New Mexico residents.

New Mexico has 142,000 veterans and it is estimated that 68% of veterans (96,560) qualify for this benefit, meaning a home they own is their primary residence and they were honorably discharged.

HJR 6 seeks a constitutional amendment to raise the exemption from $4,000 to $10,000 and index it to the amount of inflation from 2025 onward.

READ OUR COMPLETE PRESS RELEASE HERE